real property gains tax act 1976 amendment 2018

Section 44AD of the income tax Act 1961 provides that if taxpayer is engaged in the any eligible business and having a turnover of Rs. And inserted before period at end or real property and all gains or losses from the forfeiture of good-faith deposits.

What Can A President Do During A State Of Emergency The Atlantic

Amendment by section 211c1B of Pub.

. 2 crore or less its profits are deemed to be 8 per cent of. The program was exposed and condemned by Congress in 1976. Must contain at least 4 different symbols.

115141 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Mar. For provisions that nothing in amendment by section 401b12 of Pub. The initiative was approved by California voters on June 6 1978.

Designed to enforce the voting rights guaranteed by. Loans secured by an interest in real property located within an urban renewal area to be developed. Nothing in the Indian Tribal Governmental Tax Status Act of 1982 or in the amendments made thereby shall validate or invalidate any claim by Alaska Natives of sovereign authority over lands or people.

Later in the 1980s Congress began increasing the capital gains tax rate and repealing the exclusion of capital gains. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a. In the United States the non-medical use of cannabis is legalized in 19 states plus Guam the Northern Mariana Islands and the District of Columbia and decriminalized in 12 states plus the US.

Despite this CIA Director George HW. A century-old provision of the Massachusetts Constitution commands that if the commonwealth taxes income it must do so at a uniform rate Five times in the modern era in 1962 1968 1972 1976 and 1994 tax-and-spend liberals have invited voters to discard that rule and make it legal to soak the rich at higher tax rates. Virgin Islands as of May 2022.

It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. The Tax Reform Act of 1986 repealed the exclusion from income that provided for tax-exemption of long-term capital gains raising the maximum rate to 28 percent 33 percent for taxpayers subject to phaseouts. California Property Tax Transfers and Exemptions Initiative 2020 The California Association of Realtors CAR which was behind the Property Tax Transfers and Exemptions Initiative negotiated with the California State Legislature for Assembly Constitution Amendment 11.

When a property is settled under a Trust it is practically a gift and provisions of Section 562x of Income tax Act IT Act are attracted. 250 thousand sq mi of public land or nearly 10 percent of the total area of the United States was given away free to 16 million homesteaders. Decriminalization refers to a policy of reduced penalties for cannabis offenses typically involving a civil penalty for possessing small amounts similar to.

The postWorld War II economic expansion also known as the postwar economic boom or the Golden Age of Capitalism was a broad period of worldwide economic expansion beginning after World War II and ending with the 19731975 recession. 2 2013 126 Stat. The Amendment passed by two-thirds of the House with only one vote to spare.

The Voting Rights Act of 1965 is a landmark piece of federal legislation in the United States that prohibits racial discrimination in voting. Roosevelt in the United States of America between 1933 and 1939. ASCII characters only characters found on a standard US keyboard.

Effective Date of 1976 Amendment. 2315 was formerly set out as. Each amendment made by this title amending this section and sections 24 32 55 and 63 of this title shall be subject to title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 Pub.

113295 set out as a note under section 143 of this title. Proposition 13 officially named the Peoples Initiative to Limit Property Taxation is an amendment of the Constitution of California enacted during 1978 by means of the initiative process. Again President Wilson made an appeal but on September 30 1918 the amendment fell two votes short of the two-thirds necessary for passage 53-31 Republicans 27-10 for Democrats 26-21 for.

Major federal programs agencies included the Civilian Conservation Corps CCC the Civil Works Administration CWA the Farm Security Administration FSA the National Industrial. 10716 901 which was repealed by Pub. The United States of America has separate federal state and local governments with taxes imposed at each of these levels.

As per Section 562x of IT Act any cash or property immovable or movable property received by a person from anyone without consideration or for inadequate consideration is treated as. Computation of Income under Section 44AD. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

The New Deal was a series of programs public work projects financial reforms and regulations enacted by President Franklin D. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of.

It was signed into law by President Lyndon B. C to which such amendment relates see section 211d of Pub. The United States the Soviet Union and Western European and East Asian countries in particular experienced unusually high and.

23 2018 see section 401e of. 6 to 30 characters long. Benefit reduction of deemed profit rate under Section 44AD of the Income-tax Act to taxpayers who will accept digital payments.

115141 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Mar. The Homestead Acts were several laws in the United States by which an applicant could acquire ownership of government land or the public domain typically called a homesteadIn all more than 160 million acres 650 thousand km 2. A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets.

The vote was then carried into the Senate. U title IV Sec. 23 2018 for purposes of determining liability for tax for periods ending after Mar.

Bush conceded that some aid to the FNLA and UNITA continued. 113295 effective as if included in the provisions of the Tax Extenders and Alternative Minimum Tax Relief Act of 2008 Pub. For provisions that nothing in amendment by Pub.

112240 title I 101a1 Jan. The date of the enactment of the Tax Reform Act of 1984 referred to in subsec. The Clark Amendment was added to the US Arms Export Control Act of 1976 ending the operation and restricting involvement in Angola.

23 2018 for purposes of determining liability for tax for periods ending after Mar. However ACA 11 did not receive legislative approval before. Johnson during the height of the civil rights movement on August 6 1965 and Congress later amended the Act five times to expand its protections.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

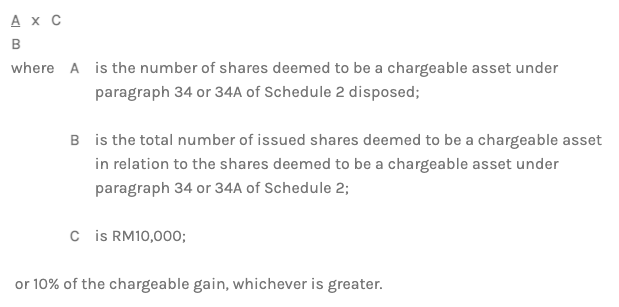

Latest Amendments In Real Property Gains Tax Iqi Global

Real Property Gains Tax Rpgt In Malaysia 2022

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Stategraft Article By Bernadette Atuahene Timothy R Hodge Southern California Law Review

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Tm2135528d1 Ex99 1sp1img002 Jpg

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

The Finance Act 2021 Key Changes To The Real Property Gains Tax Act 1976 Richard Wee Chambers S News

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

How Did The Tcja Change The Amt Tax Policy Center

Key Changes In The Real Property Gain Tax Cheng Co Group

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Amendments To The Stamp Act 1949 And Real Property Gains Tax Act 1976 Shearn Delamore Co

Amendment Bill To The Real Property Gains Tax Act 1976 And Stamp Act 1949 News Articles By Hhq Law Firm In Kl Malaysia

0 Response to "real property gains tax act 1976 amendment 2018"

Post a Comment